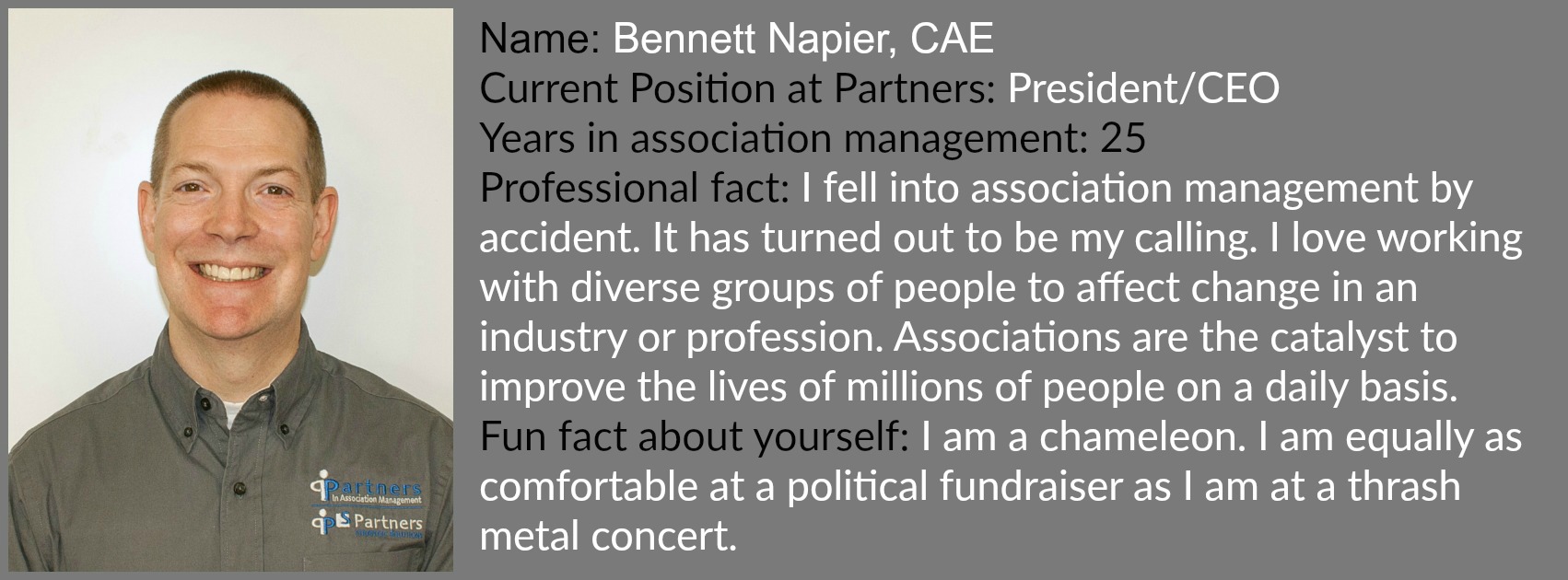

By: Bennett Napier, CAE

During my career in association management, I have been privy to a number of cases of financial mismanagement; embezzlement and other less than stellar financial practices in 501(c)(3)(4)and (6) organizations.

Unfortunately, I have had professional peers get into situations where they either inherited an organization that had been a victim of embezzlement or it occurred on their watch. Two of those cases resulted in over six figures losses to their respective organizations.

There are only a few cases that ever get media attention as most groups want to keep such activity under wraps to avoid member or donor fallout in terms of organizational confidence.

This blog focuses primarily on the board member volunteer responsibilities as it relates to financial management. However, the principles apply to staff as well.

Fiduciary duty and duty of care are paramount legal responsibilities of all nonprofit board members.

Financial mismanagement, or worse yet, embezzlement can occur within in any organization – it does not only happen in certain types of organizations. Such activity can happen in large staff run organizations, small staff organizations, or all volunteer run organizations. Furthermore, it does not solely occur in organizations with large budgets.

If there is a dollar to be had, there is potential for bad things to happen.

There is countless educational content available to train staff and board members on best practices. The problem is that sometimes “staff and/or board members can get complacent as it relates to financial duties” or “they don’t have the proper training to understand what needs to be in place”.

With that said, here are some questions to answer. These are in no priority order, but will help you do a quick scan on your organization’s practices:

- Who does the books? In-house bookkeeper? Volunteer treasurer? Outside CPA or bookkeeping firm?

- What internal controls or checks and balances are in place relative to handling money? This includes, making deposits, transferring money, check signing authority, etc.? How many people are involved in the process?

Are your financial statements/operations regularly reviewed or audited? If so, by whom?

Are your financial statements/operations regularly reviewed or audited? If so, by whom?- Does your board/staff understand the difference between cash and accrual accounting? If the answer is no, this is where some issues can enter the picture.

- How often are financial statements prepared? What software or process is used to produce them?

- Who has access to bank financial statements? How are these reconciled?

- Is there a formal operating budget established each fiscal year?

- Is there annual training on financials for new board members?

- Are financials reviewed at each board meeting? Or just certain meetings?

- Are financial materials provided in advance of the board meeting to allow adequate time for review and questions? Or are they provided during the meeting?

- If questions are posed, are they reasonably answered given the specificity or complexity of the question?

- Does your organization have adequate insurance coverage relative to financial management? Such as general liability insurance, Director’s and Officer’s Insurance (D&O) or Errors and Omissions Insurance (E&O).

Here are just a few good detailed references on this important topic!

https://www.501commons.org/resources/tools-and-best-practices/financial-management

http://www.blueavocado.org/content/nonprofit-embezzlement-more-common-and-more-preventable-you-think

http://nonprofitinformation.com/embezzlement-nonprofit/