By Rachel Luoma

Quality Control – I hear this term all the time in association management. We try to build quality control into every aspect of our work. From double checking member data entry to checking name badges before meetings, to ensuring financials are correct.

Sometimes, quality control is so engrained in everything we do, we may not realize how many layers of quality checks we have throughout our processes. Other times, we must create quality control processes to ensure that our services meet the established standards and requirements.

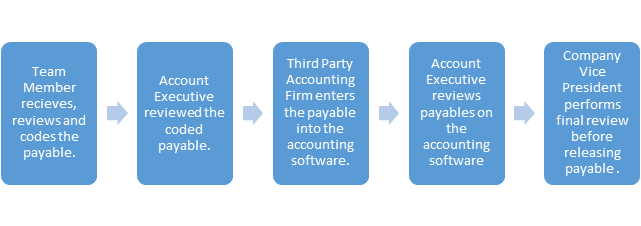

One of my favorite ways to ensure quality control is through the creation of a checklist. One recent checklist that I created is for the review and approval of payables. We have multiple layers of quality control built into the accounts payable process.

As we were going through the process, I realized that Account Executives and Vice Presidents may all review various aspects of the payable differently. To help ensure that all team members are reviewing the same elements of the payable, I created a payable review checklist.

Below are the key elements of the checklist:

- Vendor Name/Address – Is the vendor name and address correct? Do they match the invoice?

- Client Account Number (if applicable) – Does the vendor record in the accounting software correctly show the account number?

- Bill Amount – Does the amount of the payable reflect the correct amount on the invoice? If there is a past due amount on the invoice, has that been paid? If so, you can disregard. If not, contact the vendor to get a copy of the past due invoice. Do not pay multiple invoices on a single invoice.

- Invoice Number – Is the invoice number correct in the accounting software? Is the invoice an invoice or a statement? Do not pay from statements. If there is no invoice number, does the invoice number used in the accounting software follow the pattern that has been used in the past?

- Invoice Date/Due Date – What is the invoice date and the invoice due date in the accounting software? Does this match the invoice? Invoice date and due date are especially important, if a client payable needs to be attributed to a different month or year (i.e. a 2021 invoice needs to be coded back to 2020).

- Notes/Comments – Are there any notes/comments that need to be included along with the invoice in the accounting software? For example, we use a payment platform that mails our payables directly. Thus, when checks need to be returned to our office instead of mailed directly from the payment platform, we must include “Manual Check” in the notes section of the payment.

- Account Code – Is the invoice coded correctly using the chart of accounts? If the invoice needs to be split amongst multiple account codes, are these correct?

- Back-Up – In most accounting software, you can upload or attach a copy of the invoice/back-up itself into the software. Is there back-up affiliated with this payable? Does the back-up documentation support the payment amount? Is it sufficient to ensure the transaction is valid?

- Approvers – Is there a dual control approval process? Does a different person review/approve a payable than the person who input the payable into the accounting software? Is this approval process documented and followed?

- Past Payments/Duplicate Payment – Has this invoice already been paid? Most accounting software will recognize if an invoice number has been paid. However, as you are reviewing payables, it may be helpful to review your general ledger for similar amounts and/or invoice numbers. This is especially important for payables that may not have an invoice number.

At the end of the day, the quality control process is only as good as it is designed and followed. Thus, it is important that the process is documented, reviewed and refined.

So, as you review my checklist for reviewing payables, what is missing? Leave a comment and let me know.

Rachel Luoma, MS, CAE – Vice President. Rachel has been involved in associations for over 15 years and has experience in all areas of association management. She holds a Master’s Degree in Adult Education and holds the Certified Association Executive designation. Rachel was named a Young and Aspiring Professional by Association Trends Magazine, Executive of the Year by the Florida Society of Association Executives and was recognized as one of Association Forum’s and USAE’s Forty Under 40® Awards recipients. She is a former Chair of the Florida Society of Association Executives. Fun Fact: When she’s not doing her association management thing, Rachel rocks out as lead singer with Tallahassee’s hottest cover band – Suckerdust!