By: Dee Kring, CAE, CMP

What is the first thing you would do if your organization were faced with a lawsuit? I’m not an attorney, nor an insurance agent, so it may seem strange for me to answer this question. However, I’ve learned a few lessons in my association management career that I’m compelled to pass on to other association professionals because many of us (perhaps in a state of panic) would answer the question with “call an attorney”. I will save you the call and tell you the first question an attorney will ask you: “what type of insurance do you have?”

Hopefully, you are never faced with this scenario, but in a world where lawsuits abound, it is not uncommon. Nonprofits are not exempt from them either. In fact, according to a recent Towers and Watson Directors and Officers Liability Survey, nonprofit organizations may be more at risk of litigation than for-profit companies, as 63% of nonprofit organizations reported a D&O claim between 2002-2012 as compared to 27% of for-profit companies. Contract disputes, employment issues and personal injury claims top the list for nonprofits; but there are inherent risks also with certification programs. As stated in Association Law Blog, “The credentialing program may end up being the standard for the industry or profession. Reasonable reliance on the certification as being fully appropriate could result in liability based on the certification or standard being negligently established. There is also risk of liability if the certifying entity grants a certification to individuals/entities that the certifier knew or should have known should not have been certified.”

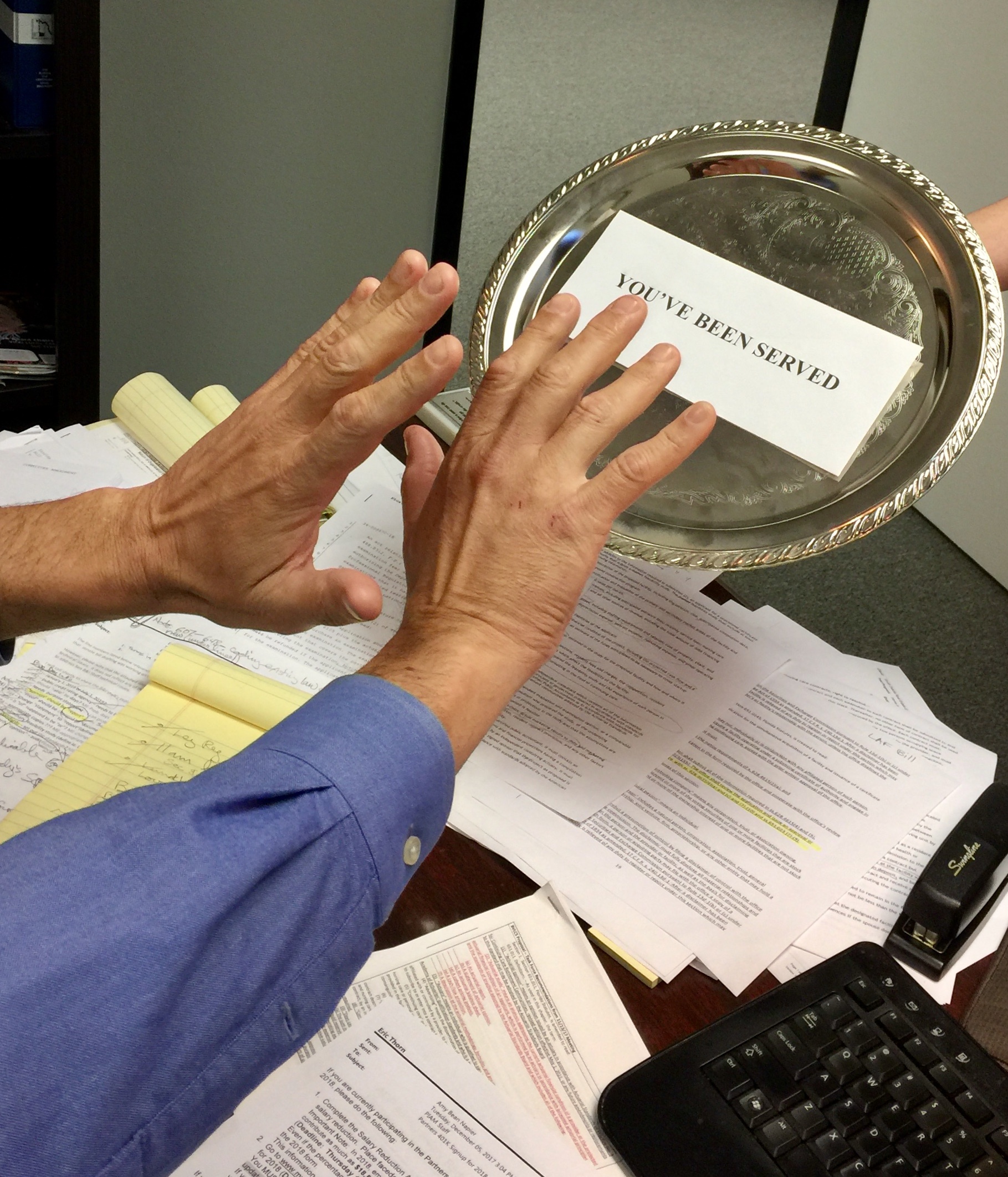

If you’ve been served, the first thing you should do is call your insurance agent. It’s very important that you do this immediately. Once you’ve been served, the clock starts ticking and you have 30 days to respond. Call your insurance agent, even if you don’t think you have the correct policy in place for coverage.

If you’ve been served, the first thing you should do is call your insurance agent. It’s very important that you do this immediately. Once you’ve been served, the clock starts ticking and you have 30 days to respond. Call your insurance agent, even if you don’t think you have the correct policy in place for coverage.

Insurance policies are often broad in scope, a bit difficult to understand, and it’s possible there is coverage where you may have assumed there wasn’t. It’s important for you to do this first before hiring an attorney. If the insurance company accepts your claim, they will assign an attorney to the case. You will be responsible for paying your deductible, so invoices will come directly from the law firm with a copy to the insurance company. Once you have met your deductible, the insurance company will pay the remainder of the attorney’s fees.

Alternatively, if you hire an attorney prior to submitting an insurance claim, and then your claim is accepted, the legal fees you have paid out of pocket will not be reimbursed. Besides, insurance companies typically have their own pool of attorneys and your case will lose the consistency of representation if you have already hired legal counsel.

Has this scenario got you thinking? It should. Schedule some time in the immediate future to do these three things:

- Take an inventory of your association’s insurance policies

- Assess your risk

- Match your coverage to risk

There are many different types of policies covering various risks. The following are the standard types of policies for associations and the risks they address:

Cyber Liability Insurance – Sometimes linked to media-liability coverage, cyber liability insurance offers coverage for claims of libel, slander, infringement of copyright or trademark, and so forth. It may also provide protection for the loss of electronic data and costs associated with re-creating such data.

Directors and Officers Liability Insurance – D&O covers personal liability and financial loss incurred by executives and board members as a result of wrongful acts committed (or allegedly committed) by them in their capacities as corporate officers.

Employment Practices Liability Insurance – Often a standard part of D&O coverage, EPLI covers allegations made by employees or former employees, which can include claims of wrongful termination, discrimination, or failure to promote, among others.

Errors and Omissions Liability Insurance – E&O can provide coverage for an organization’s certification activities as well as for exposure resulting from the setting of industry standards.

Event Cancellation Insurance – This kind of policy offers protection from losses incurred as a result of an event being cancelled.

Personal and Advertising Injury Insurance- Generally found as part of other types of insurance coverage such as D&O and general liability, personal and advertising injury insurance provides coverage for areas such as libel, slander, and infringement of copyright or trademark.

We can’t predict the future, and we can do everything within our control to safeguard ourselves and our organizations from litigation, but the fact remains that it is still very likely we will be faced with a lawsuit. If that happens, you will be glad you have the proper insurance in place, and know who to consult with first.